Residence Permit Retired 50+

Retirement on Mauritius

Hedge your lifestyle.

Mauritius has attracted more and more Europeans (France, Switzerland, Belgium, UK, Italy, Germany..) and South Africa with immigration measures for their retirement and you will be made feel welcome in retiree´s tropical paradise island. More and more Europeans choose that unique way of lifestyle and live here happy sunny days in Mauritius, and have the feeling of being home away from home.

- Retirement Scheme for non-resident-citizens/foreigners

- Residence Permit Retired 50+

Seeking for new way of live and better living conditions

with lifequality, tax advantages, exceptionally favourable tax conditions (15% income tax, no dividends and capital gains tax, no inheritance tax.. etc), living conditions, well-developed health care system, stable political and financial system.

Risk reduction of European issues and instability and recent Euro curreny risks in the Euro Zone despite the economic crisis prevailing in Europe. More and more Europeans age 50+ or seniors that wish to spend more than 6 months a year in Mauritius and take that step and move and live happy sunny days in an lifestyle in great tropical environment with international cosmopolitan atmosphere.

Mauritius is a popular choice and has become a popular destination trend now for many foreign retirees who want to live permanent or also ideal for a second residence or retire permanent overseas or just longterm stay during the wintermonths from abroad in a pleasant tropical climate.

Mauritius opens more and more to Europe and Europeans.

Mauritius is an island of thriving tourism industry with deserving paradise reputation with an abundance of sun, sea and in addition to its white sand beaches and quality of life and lifestyle, climate and pleasant living conditions Mauritius is an island of diversity, natural beauty, culture, wealth of attractions, good infrastructure and medical services and well developed health care system with a high standard of medical treatment.

Mauritius is one of the most popular destinations for foreigners to buy a second home and is a magnet for high-wealth international individuals.

The island offers great tax benefits, and benefits for a low crime rate, excellent climate, beautiful landscape and beaches, main languages are English and French making it a convenient destination of European expats or investors good flight connections add to the attraction of the island.

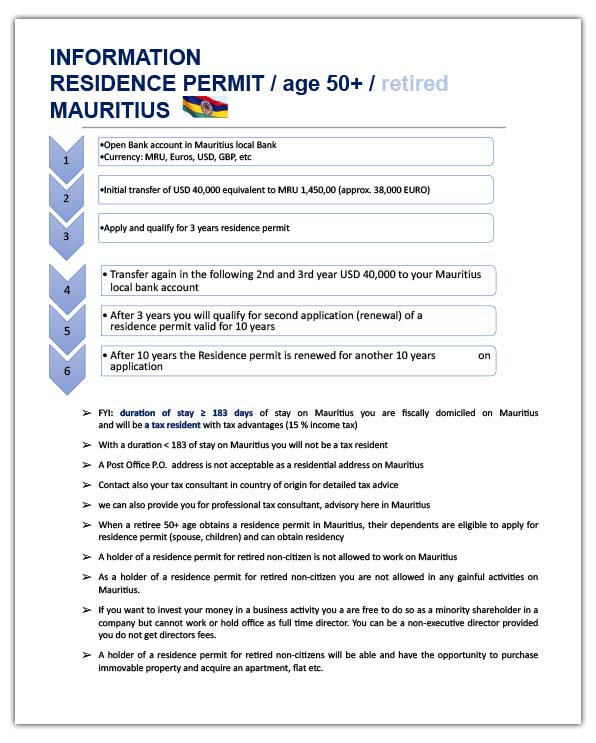

Criterias to apply and qualify for Residence Permit as Retired Non-Citizen on Mauritius

To be eligible for a residence permit as a retired non-citizen you should be 50 years of age, or above, and must undertake to transfer, to your local bank account in Mauritius, at least USD 40,000 annually, or its equivalent in any freely convertible foreign currency.

You should submit proof of an initial transfer of at least USD 40,000 or its equivalent in freely convertible foreign currency at time of application.

The total amount transferred over three years should be USD 120,000. After three years ,you will qualify for a residence permit, valid for ten years, and so have a permanent resident status. After ten years, you apply again for prolongation again for ten years etc..

With the retired residence permit you will have the opportunity to apply and acquire an apartment flat on Mauritius.

As a retired non-citizen, you are not allowed to engage in any gainful activities in Mauritius. However, if you want to invest your money in a business activity, you are free to do so as a minority shareholder in a company, but you cannot work or hold office as a full-time company director. You can be a Non-Executive Director provided you do not get Director’s Fees.

The law does not provide for a minimum number of days per year to stay in Mauritius under a Residence Permit. However, to be considered as a ‘resident’ for tax purposes, you should stay in Mauritius for a minimum of 183 days per calendar year.